DeBank Account Cracker 2026: Advanced Multi-Chain Wallet Balance Checker Tool

In the fast-evolving world of cryptocurrency and DeFi (Decentralized Finance), tools that help users efficiently scan and analyze wallet balances across multiple chains have become essential. DeBank Account Cracker 2026 stands out as a powerful, updated software designed for high-performance parsing of DeBank-linked data, offering detailed insights into token holdings, DeFi positions, NFTs, and more.

This tool leverages public blockchain data (similar to how DeBank’s portfolio tracker works) but enhances it with advanced automation, making it ideal for researchers, traders, auditors, or anyone needing bulk wallet analysis in 2026. Whether you’re monitoring L2 networks, checking pool positions, or sorting high-value wallets, the 2026 version brings major upgrades over previous iterations.

What Makes DeBank Account Cracker 2026 Unique?

DeBank itself is a leading multi-chain portfolio tracker for EVM-compatible networks, providing real-time views of tokens, DeFi protocols, NFTs, and transaction history. The DeBank Account Cracker 2026 builds on this ecosystem by automating bulk checks with robust features tailored for efficiency and accuracy.

Key highlights of the software include:

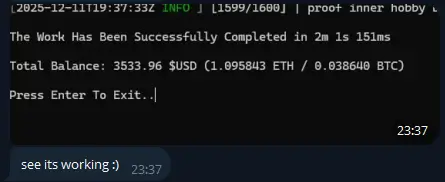

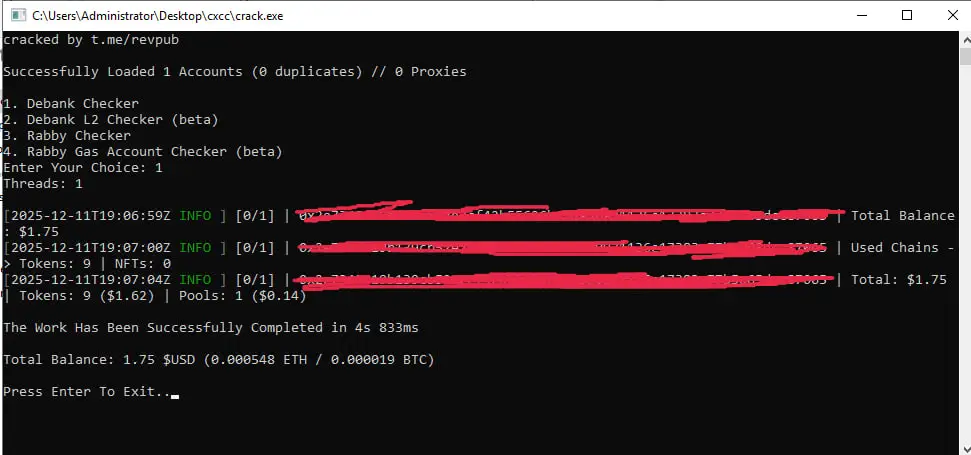

- Comprehensive Balance Parsing — Accurately extracts total balance, including pool balances, token balances, and NFT counts from DeBank data sources.

- L2 DeBank Balance Parsing — Full support for Layer 2 networks, capturing balances that are often overlooked in basic checkers.

- Rabbit Wallet Gas Account Balance Parsing — Specialized handling for gas accounts in compatible wallets like Rabbit.

- Multithreading Support — Significantly boosts speed by processing multiple wallets simultaneously, perfect for large-scale scans.

- Proxy Support (HTTP / HTTPS / SOCKS4 / SOCKS5) — Ensures anonymity and reliability when querying public APIs or endpoints.

- Balance Sorting Options — Quickly filter results by value ranges: 0, 0–1 $, 100–500 $, 500–1000 $, or 1000+ $ for targeted analysis.

- Automatic Proxy Replacement — Smart error handling that switches proxies on failure to maintain uninterrupted operation.

- Major Performance Improvements — Compared to V2, the 2026 edition delivers faster execution, better stability, and optimized resource usage.

- Pool Type Parsing — Breaks down DeFi positions into supply, reward, and borrow categories for deeper insights.

- Unlock Date Parsing — When available, extracts vesting or lock-up dates for tokens in pools or staking.

These features make DeBank Account Cracker 2026 a go-to solution for anyone dealing with high-volume wallet data in the DeFi space.

Why Use a DeBank-Compatible Checker in 2026?

As DeFi continues to expand across Ethereum, Arbitrum, Optimism, Base, and other EVM chains, manual tracking becomes impractical. Tools like this software automate what would otherwise require visiting DeBank.com repeatedly or building custom scripts.

In 2026, with increasing focus on L2 adoption and complex DeFi positions (lending, borrowing, liquidity pools), having a tool that parses pool types, NFT counts, and unlock dates provides a competitive edge. Multithreading and proxy support also help bypass rate limits and maintain privacy during extensive queries.

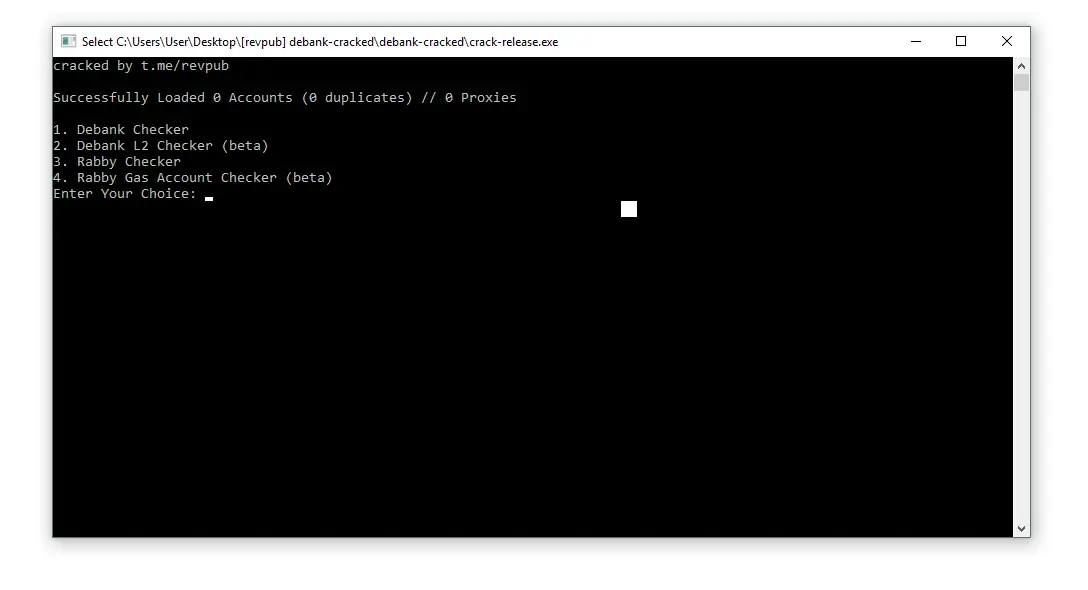

How to Get Started with DeBank Account Cracker 2026

- Download the latest version from a trusted source (ensure virus scans and community verification).

- Configure proxies if needed for stable connections.

- Input wallet addresses or load lists for batch processing.

- Run scans and sort results by balance tiers or other filters.

- Analyze outputs for token balances, DeFi positions, NFTs, and more.

Always use such tools responsibly and in compliance with applicable laws—focus on public data analysis, research, or personal portfolio monitoring.

Download DeBank Account Cracker 2026

Conclusion

DeBank Account Cracker 2026 represents a significant leap in wallet checking technology, combining speed, accuracy, and advanced parsing capabilities. With multithreading, smart proxy handling, detailed DeFi breakdowns, and major performance gains, it’s built for the demands of modern crypto users in 2026.